The Basic Principles Of Bankruptcy Attorney Tulsa

Table of ContentsThings about Tulsa Bankruptcy Filing AssistanceExamine This Report on Top Tulsa Bankruptcy LawyersThe Ultimate Guide To Tulsa Bankruptcy AttorneySome Known Incorrect Statements About Best Bankruptcy Attorney Tulsa Not known Facts About Affordable Bankruptcy Lawyer Tulsa

The statistics for the various other main kind, Chapter 13, are also worse for pro se filers. (We damage down the distinctions in between the two enters deepness listed below.) Suffice it to say, consult with a legal representative or two near you that's experienced with bankruptcy legislation. Below are a couple of resources to locate them: It's easy to understand that you may be hesitant to pay for a lawyer when you're currently under substantial monetary stress.Lots of attorneys likewise provide totally free consultations or email Q&A s. Take benefit of that. Ask them if bankruptcy is certainly the appropriate choice for your situation and whether they think you'll certify.

Advertisements by Money. We might be compensated if you click this ad. Ad Since you have actually chosen personal bankruptcy is without a doubt the right strategy and you ideally removed it with a lawyer you'll need to get started on the documentation. Prior to you study all the main bankruptcy kinds, you must obtain your very own documents in order.

Top Tulsa Bankruptcy Lawyers Things To Know Before You Buy

Later on down the line, you'll in fact need to verify that by revealing all types of info concerning your economic events. Below's a fundamental listing of what you'll require when traveling ahead: Recognizing documents like your vehicle driver's permit and Social Protection card Income tax return (up to the past four years) Proof of revenue (pay stubs, W-2s, self-employed revenues, income from assets in addition to any type of earnings from federal government advantages) Financial institution declarations and/or retirement account declarations Proof of worth of your properties, such as vehicle and actual estate valuation.

You'll want to comprehend what kind of financial obligation you're attempting to settle.

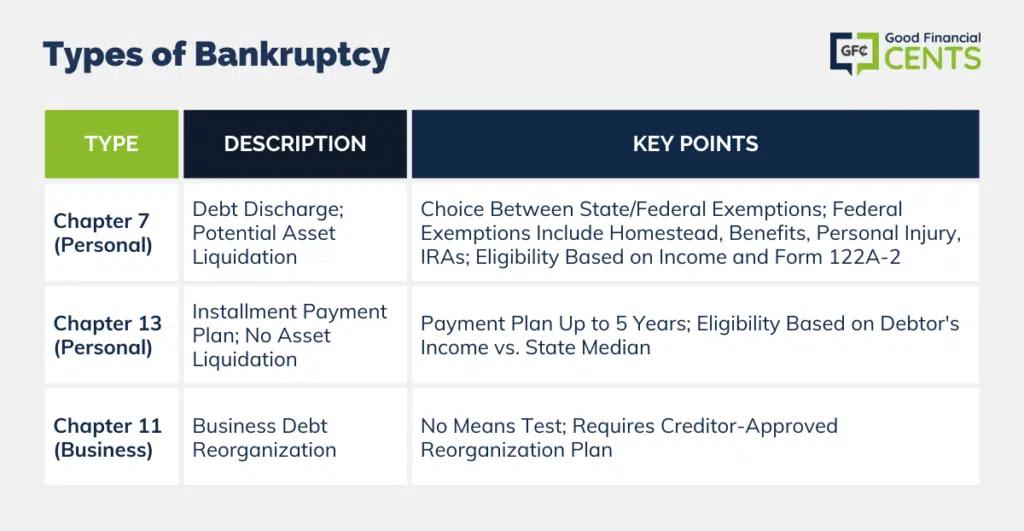

You'll want to comprehend what kind of financial obligation you're attempting to settle.If your income is too high, you have an additional option: Chapter 13. This alternative takes longer to fix your financial obligations because it calls for a long-term repayment strategy normally 3 to five years prior to several of your continuing to be debts are wiped away. The declaring process is also a lot extra complicated than Phase 7.

The smart Trick of Tulsa Bankruptcy Legal Services That Nobody is Talking About

A Chapter 7 insolvency stays on your credit report for 10 years, whereas a Chapter 13 insolvency diminishes after seven. Both have long-term influence on your credit history, and any kind of brand-new debt you obtain will likely include higher rates of interest. Prior to you submit your personal bankruptcy forms, you must first complete a mandatory course from a credit therapy agency that has been accepted by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The course can be completed online, additional reading personally or over the phone. Training courses usually cost between $15 and $50. You should complete the training course within 180 days of filing for insolvency (bankruptcy attorney Tulsa). Make use of the Division of Justice's site to locate a program. If you stay in Alabama or North Carolina, you need to choose and finish a training course from a list of individually approved suppliers in your state.

The Ultimate Guide To Tulsa Ok Bankruptcy Specialist

Inspect that you're filing with the correct one based on where you live. If your copyright has actually relocated within 180 days of filling, you should file in the district where you lived the higher portion of that 180-day duration.

Typically, your personal bankruptcy lawyer will function with the trustee, yet you might need to send out the person additional info files such as pay stubs, tax returns, and financial institution account and credit scores card declarations straight. An usual misconception with personal bankruptcy is that as soon as you file, you can stop paying your financial obligations. While bankruptcy can assist you wipe out numerous of your unsafe financial debts, such as overdue clinical expenses or individual loans, you'll want to maintain paying your monthly repayments for guaranteed financial obligations if you want to keep the property.

6 Easy Facts About Experienced Bankruptcy Lawyer Tulsa Described

If you go to danger of repossession and have exhausted all other financial-relief options, after that declaring Chapter 13 might delay the foreclosure and help conserve your home. Ultimately, you will certainly still need the revenue to continue making future home mortgage payments, along with repaying any type of late settlements throughout your repayment strategy.

If so, you might be required to give added info. The audit could delay any financial debt relief by several weeks. Certainly, if the audit shows up wrong info, your instance can be dismissed. All that said, these are relatively rare circumstances. That you made it this far while doing so is a decent indication at the very least several of your financial debts are qualified for discharge.